Category: Medicaid

-

Preparing for Alabama’s Medicaid Unwinding Process

By: Alli Swann and Kelli C. Fleming, Esq. – Burr & Forman LLP Over the past three years, Medicaid recipients have benefitted from uninterrupted coverage, contributing to one of the lowest periods of U.S. uninsurance. However, with the public health emergency’s (“PHE”) end reintroducing traditional Medicaid redetermination plans, Alabama providers should prepare for a potential…

-

American Rescue Plan Offers $940 Million for Medicaid Expansion and Other Benefits for Healthcare

The American Rescue Plan Act of 2021, signed by President Biden on Thursday, includes a number of key provisions that strengthen both public and private health insurance coverage. Among its Medicaid and the Children’s Health Insurance Program (CHIP) provisions, the American Rescue Plan encourages states to finally take up the Medicaid expansion by offering even…

-

Summary of Telehealth Waivers as of April 1, 2020

By: Jim Hoover, Burr & Forman, LLP The changes made to the requirements for telehealth services since the start of the COVID-19 pandemic have been swift and substantial. For the first several weeks, it seems changes were made almost daily. As time has passed, the changes to telehealth have stabilized enough that a summary of…

-

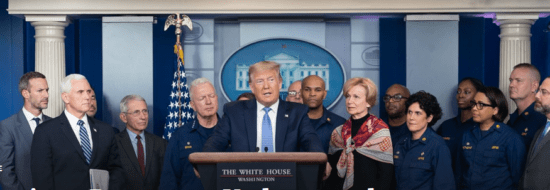

Families First Coronavirus Response Act (HR6201) Summary

Last night President Trump signed what is being called the second coronavirus stimulus bill. It provides for free coronavirus screening, $1 billion in additional unemployment insurance funding to all states, a bump in Medicaid FMAP, $1 billion in food aid, and two provisions to provide paid sick leave to employees. Emergency Paid Sick Leave This…

-

CMS Releases Physician Fee Schedule Final Rule

The Centers for Medicare and Medicaid Services (CMS) released its final rule for the CY 2020 Physician Fee Schedule. The Medical Association and the AMA will continue to review the rule and analyze these policies in the coming weeks. Attached is a summary of some of the policies CMS finalized in the rule. Some of…

-

Changes Coming to AKS, Stark and CMP Laws

On October 9, 2019, the Office of Inspector General (“OIG”) and the Centers for Medicare and Medicaid Services (“CMS”) published proposed rules to revise the Stark Law, Anti-Kickback Statute and Civil Monetary Penalty Statute. These statutes create criminal and civil penalties for certain financial arrangements involving providers. According to OIG and CMS, the goal of…

-

CMS Is Expanding Its Enforcement Ability

Pursuant to a new rule, entitled Program Integrity Enhancements to the Provider Enrollment Process, the Centers for Medicare & Medicaid Services (“CMS”) is expanding its ability to combat fraud and abuse within the healthcare industry. Under the new rule, CMS will be able to identify individuals and entities that pose a fraud and abuse risk…