Category: Legal Watch

-

OIG Issues Favorable Advisory Opinion Allowing Free Pharmaceutical Product To Patients

By Jim Hoover, Burr & Forman LLP On January 15, 2025, the Office of Inspector General (OIG) posted a favorable Advisory Opinion regarding a program to provide free access to a pharmaceutical product to patients who meet financial and other eligibility criteria and who do not have adequate coverage for the product. The Advisory Opinion…

-

Avoid Fines and Penalties by Timely Responding to Requests for Patient Records

By: Angie Cameron Smith, Burr & Forman LLP The Office of Civil Rights (“OCR”) routinely makes announcements about enforcement actions taken against healthcare providers. One such enforcement action is a civil money penalty (“CMP”) related to a provider’s failure to timely comply with a request for medical records from a patient. So far in 2024,…

-

FTC’s Non-Compete Ban Blocked by Federal Judge

By: H. Carlton Hilson, Amy Jordan Wilkes, and Gabriell Jeffreys, Burr & Forman LLC On August 20, 2024, a federal judge in Texas blocked a Federal Trade Commission (FTC) final rule from taking effect that would effectively ban most employee non-compete agreements. The rule, which was set to take effect on September 4, 2024, would…

-

The FTC Expands Notification Requirements for Health Breaches on Health Apps

By: Ashton Brock, Burr & Forman LLP On April 26, 2024, the Federal Trade Commission (FTC) published a final rule aiming to clarify the current Health Breach Notification Rule (HBN Rule), giving greater protections and expanding breach notification requirements for vendors of personal health information who are not regulated by HIPAA. Pursuant to the FTC,…

-

Court Issues Ruling in Abortion Prosecution Lawsuits

In the latest fallout from the US Supreme Court Dobbs decision, on Monday, May 6, 2024, Judge Myron Thompson of the US District Court for the Middle District of Alabama issued an order granting in part and denying in part Alabama Attorney General Steve Marshall’s Motion to Dismiss two federal court actions alleging violations of…

-

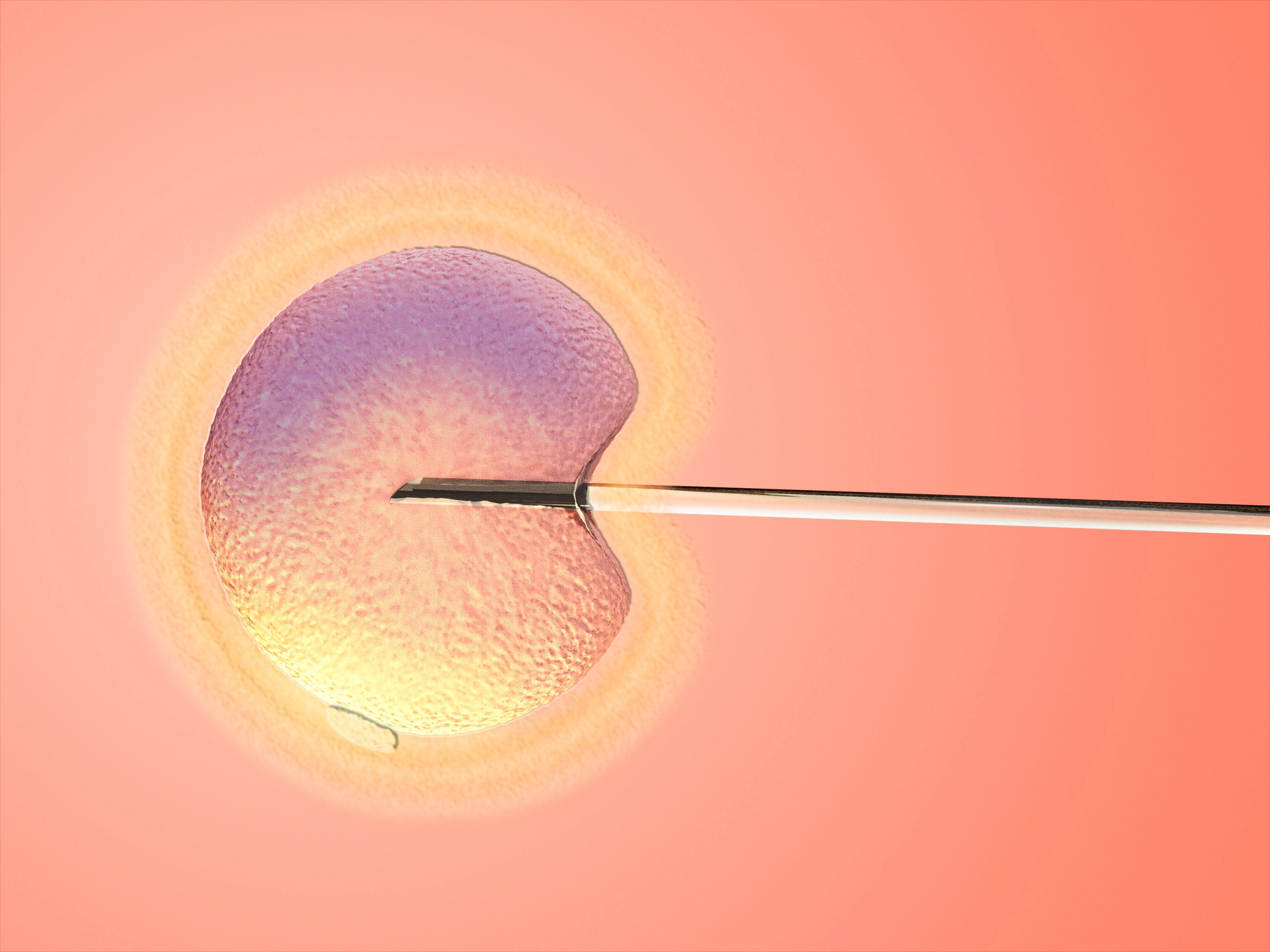

Statement by the Medical Association of Alabama on the Recent Alabama Supreme Court Ruling on the Legal Status of Embryos

The Medical Association of the State of Alabama expresses concern over the recent Alabama Supreme Court decision regarding the legal status of embryos, as it relates to In-Vitro Fertilization (IVF) procedures that may result in a woman becoming pregnant. The significance of this decision impacts all Alabamians and will likely lead to fewer babies—children, grandchildren,…

-

OCR Issues Guidance on Visitation Discrimination

in Hospitals and Long Term Care FacilitiesBy: Angie C. Smith, Burr & Forman LLP Visitation in long-term care facilities and hospitals received a lot of attention during COVIDbecause of facility closures that led to limited visitation, and it is now a topic of interest for theOffice of Civil Rights (OCR) due to discrimination concerns. On January 25, 2024, OCR issuedguidance to…

-

Cyber-attacks on the Rise (Once Again…)

By: Kelli C. Fleming, Esq., Burr & Forman Cyber-attacks within the healthcare industry are continuing to rise, despite increased awareness, security measures, and training. The attacks are not only becoming more far-reaching, with each attack impacting more and more patient data, but are also more prevalent as well. Threat actors do not discriminate against victims,…

-

Proposed Penalties for Information Blocking Violations

By: Kelli C. Fleming, Esq. with Burr & Forman LLP On October 30, 2023, the Department of Health and Human Services (“HHS”) released a proposed rule establishing penalties against healthcare providers who violate the information-blocking rules implemented under the 21st Century Cures Act. The information blocking rules prohibit a healthcare provider, among other “actors” as…

-

New OIG Advisory Opinion Reinforces OIG’s Stance Against Turnkey Contractual Joint Ventures

By: Jessie Bekker, Burr & Forman LLP The Office of Inspector General (“OIG”) has issued a new opinion with a familiar message cautioning providers against entering into suspect contractual joint ventures. The OIG’s latest Advisory Opinion examined the Anti-Kickback Statute’s application to an arrangement related to the provision of intraoperative neuromonitoring (“IONM”) services (the “Proposed…