Category: Medicare

-

Congress Considers Expanding Medicare Coverage for Prescription Weight Loss Medications

By: Jessie Bekker, Burr & Forman LLP Some Congressional leaders voted to expand Medicare coverage for prescription medications to treat obesity. The House of Representatives Ways and Means Committee voted in late June to pass the Treat and Reduce Obesity Act of 2023. If passed, the bill would approve Medicare Part D coverage for glucagon-like…

-

Inside the massive proposed 2023 Medicare physician pay schedule

The Medical Association of the State of Alabama is working with the AMA and national specialties to analyze CMS’s proposed physician fee schedule for 2023 to determine its impact on physician practices. The Medical Association in partnership with these other medical organizations will provide appropriate comments to CMS once the full impact of the proposal…

-

American Rescue Plan Offers $940 Million for Medicaid Expansion and Other Benefits for Healthcare

The American Rescue Plan Act of 2021, signed by President Biden on Thursday, includes a number of key provisions that strengthen both public and private health insurance coverage. Among its Medicaid and the Children’s Health Insurance Program (CHIP) provisions, the American Rescue Plan encourages states to finally take up the Medicaid expansion by offering even…

-

Summary of Telehealth Waivers as of April 1, 2020

By: Jim Hoover, Burr & Forman, LLP The changes made to the requirements for telehealth services since the start of the COVID-19 pandemic have been swift and substantial. For the first several weeks, it seems changes were made almost daily. As time has passed, the changes to telehealth have stabilized enough that a summary of…

-

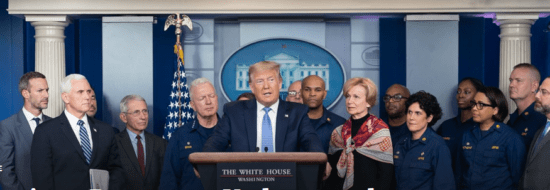

Families First Coronavirus Response Act (HR6201) Summary

Last night President Trump signed what is being called the second coronavirus stimulus bill. It provides for free coronavirus screening, $1 billion in additional unemployment insurance funding to all states, a bump in Medicaid FMAP, $1 billion in food aid, and two provisions to provide paid sick leave to employees. Emergency Paid Sick Leave This…

-

Appropriate Use Criteria for Advanced Diagnostic Imaging

Contributed by: Gregg Everett, Gilpin Givhan The Protecting Access to Medicare Act (PAMA) was passed in 2014. PAMA required the Centers for Medicare and Medicaid Services (CMS) to establish a program that promotes “Appropriate Use Criteria” (AUC) for advanced diagnostic imaging. AUC’s are evidence-based criteria that assist professionals who order and furnish certain imaging services…

-

CMS Releases Physician Fee Schedule Final Rule

The Centers for Medicare and Medicaid Services (CMS) released its final rule for the CY 2020 Physician Fee Schedule. The Medical Association and the AMA will continue to review the rule and analyze these policies in the coming weeks. Attached is a summary of some of the policies CMS finalized in the rule. Some of…

-

Changes Coming to AKS, Stark and CMP Laws

On October 9, 2019, the Office of Inspector General (“OIG”) and the Centers for Medicare and Medicaid Services (“CMS”) published proposed rules to revise the Stark Law, Anti-Kickback Statute and Civil Monetary Penalty Statute. These statutes create criminal and civil penalties for certain financial arrangements involving providers. According to OIG and CMS, the goal of…