Keep Calm & Carry On… Insight for Changes in Post-Election Uncertainty

The year 2017 is going to be a year of change like we have not seen for a very long time. For some, it’s a welcomed change. For others, it’s not. The uncertainty of the details/extent of the changes makes planning difficult, if not impossible. As a business owner, you want to be prepared. So how do you get ready when faced with so much uncertainty? We think the best way is to stay the course — Keep Calm & Carry On. In other words, make decisions based on what you know and keep moving forward until you have more certainty.

President Trump promised a lot, especially in his first 100 days in office. The timeline below can help you stay calm and focused when the media begins reporting on the new President’s 100 Day Plan in the coming months.

January 3

Congress returns to Washington

January 20

Inauguration of President-elect Trump

January 23

IRS accepts e-filing of returns. This is the official start of 2017 Tax Season.

January 31

Due date for W-2s and 1099s; new deadline for this year for Forms 1094 and 1095s to employees

February 28

Due date for paper-filed Forms 1094-C and 1095-C to IRS

March 15

Due date for corporate business returns and new this year, partnership/LLC returns

March 31

Due date for e-filed Forms 1094-C and 1095-C to IRS

April 18

Due date for individual tax returns and first quarter estimated tax payment. Due date extended by Federal law through the weekend because of Washington, D.C. holiday on Friday, April 15.

April 30

End of President Trump’s first 100 days

Tax season officially started January 23. The first date e-filed returns will be accepted by the IRS marks the opening of tax season. However, get your tax information ready early and send to your tax preparer. This is going to be a very busy tax season with several new early due dates. As news comes from Washington during the first 100 days, your tax preparer will be bombarded with questions about how the changes impact taxes. President Trump’s tax reform changes will require additional planning by you and your tax preparer. The sooner you get your information to your tax preparer, the better.

Extension for tax return. Additional time may be needed to make decisions for accounting methods that defer income or accelerate deductions. An extension gives certain individuals additional time to make retirement plan contributions or recharacterize contributions to a Roth IRA.

New tax due dates for partnerships and LLCs. Historically, Partnerships and LLCs had a due date of April 15. Starting in 2017, this due date will be March 15. This shortened filing period means a compression of time for filing these returns on the same date as corporation returns. Schedule K-1s are required to be provided to the entity’s partners. LLPs and general partnerships must file their tax returns by March 15 or file extensions.

Affordable Care Act Repeal. As of the writing of this article, the Senate has voted to move ahead with the fiscal 2017 budget resolution that would include reconciliation instructions repealing Obamacare. Both the Senate and House hope to see the budget resolution adopted by January 20. Repeal could come quickly but changes, including ACA’s tax provisions, may not be in place until 2018 or later. Predictions from various members of Congress indicate no changes in 2017.

Mandated penalties. In 2016, ACA penalties increase to $695 per adult or 2.5 percent of income, with a family maximum of $2,085 per person. This is a significant increase from the 2015 penalty of $285 per adult or 2 percent of income above the filing limit. Even with repeal of Obamacare contemplated, this penalty will apply for 2016 tax returns.

Form 1094 and 1095 Reporting. These forms are prepared by employers to report the health insurance coverage offered by employers and accepted by employees. The sole purpose of the form is to assess penalties under the individual mandate penalty and the applicable large employer penalty. Until the law is repealed, employers should continue to follow the law regarding offering of qualified health insurance and file the returns required. Starting with the 2016 reporting year, employers with 50 or more full-time employees must file these forms. The due date of these forms changed in 2017 and are required to be furnished to employees by January 31. An automatic extension was provided by the IRS pushing this date to March 2, 2017. No other extension will be approved for furnishing these forms to employees. However, it’s important to remember the forms are required to be filed with the IRS by February 28 if filing on paper or March 31 if filing electronically. An extension of time can be obtained for filing with the IRS.

MACRA and MIPS. There is no indication that these requirements will be repealed along with the repeal of Obamacare. Opinion from leading experts is that these payment programs will stay in place. What you do in 2017 will determine your MIPS payment adjustment in 2019. It is very important that you not wait but get on board. Penalties start at 4 percent in 2019, 5 percent 2020, 7 percent 2021 and 9 percent in 2022 and forward. In the MACRA final rule, CMS added several ways for doctors to participate. They call the various options Pick Your Pace. With Pick Your Pace, hardly anyone will be penalized – but you must choose how much you will participate in MIPS in 2017 to benefit from the new options.

Delayed Refunds. The IRS expects to issue most refunds in less than 21 days. However, the PATH act of 2015 mandates the IRS hold refunds on tax returns claiming the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC) until February 15.

Article contributed by Patti G. Perdue, CPA.CITP, Jackson Thornton CPAs and Consultants. Jackson Thornton is a Bronze Partner with the Medical Association. The information in this article is not intended as tax or legal advice. Please consult your tax advisor for specific information regarding your individual situation.

Posted in: Management

Leave a Comment (0) →

Dr. Cornelius Nathanial Dorsett was born a slave sometime between 1852 and 1859 in Davidson County, NC. He was separated from his mother, when she was sold, when he was just 2 months old. He was also the first African-American to pass the Alabama State Medical Examination.

Dr. Cornelius Nathanial Dorsett was born a slave sometime between 1852 and 1859 in Davidson County, NC. He was separated from his mother, when she was sold, when he was just 2 months old. He was also the first African-American to pass the Alabama State Medical Examination.

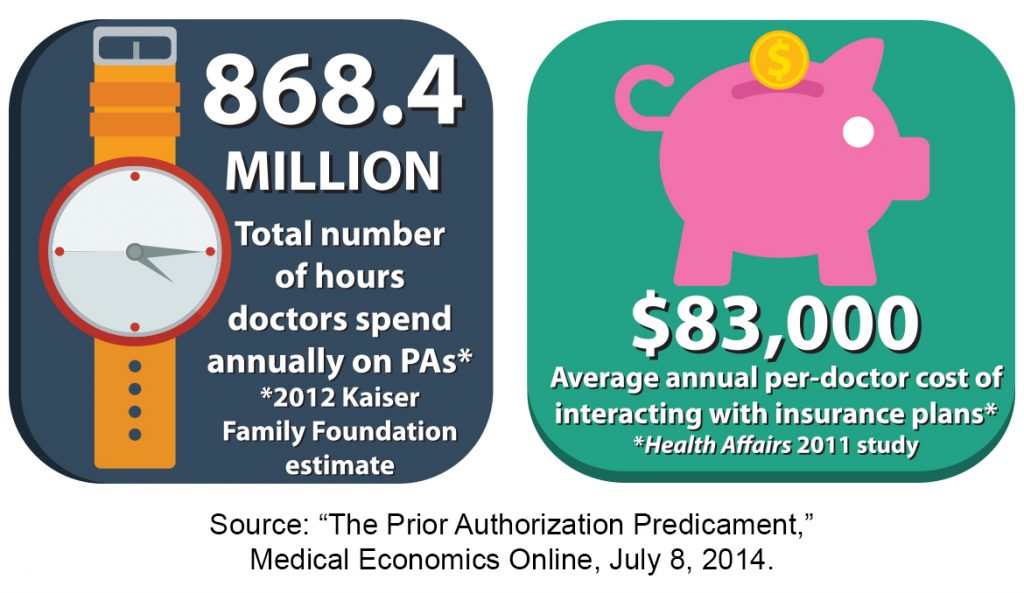

“When a patient comes in that you’ve been treating for months or even years, and you know there’s something new out there that will work better for that situation, you want to find what works best for your patient. Most of the time, that medication is going to be a generic, which is covered by most insurance plans because it’s cheaper for them and it’s cheaper for your patient. But, what if that med doesn’t work for your patient? What if your patient is allergic to that med or another med? You have to find a balance. That’s the key,” Dr. Carter said.

“When a patient comes in that you’ve been treating for months or even years, and you know there’s something new out there that will work better for that situation, you want to find what works best for your patient. Most of the time, that medication is going to be a generic, which is covered by most insurance plans because it’s cheaper for them and it’s cheaper for your patient. But, what if that med doesn’t work for your patient? What if your patient is allergic to that med or another med? You have to find a balance. That’s the key,” Dr. Carter said.