Between Doctors & Patients: Prior Authorizations

Physicians face various regulatory and administrative hurdles in a day, but few are as frustrating, or as expensive, as prior authorizations, or PAs. Commercial insurance companies, Medicaid, Medicare and other third-party interests use PAs to reduce costs. This leaves physicians and their staff wondering when the practice of medicine became more about the dollars and cents than what makes sense for patients?

“The system is there for a reason, and we understand that,” Lee Carter, M.D., said. Dr. Carter practices family medicine in Autaugaville, a rural community in Autauga County with a population of less than 1,000. “But, it can be very frustrating, not only to the physicians and our staff, but to the patients who have to wait for their medications.

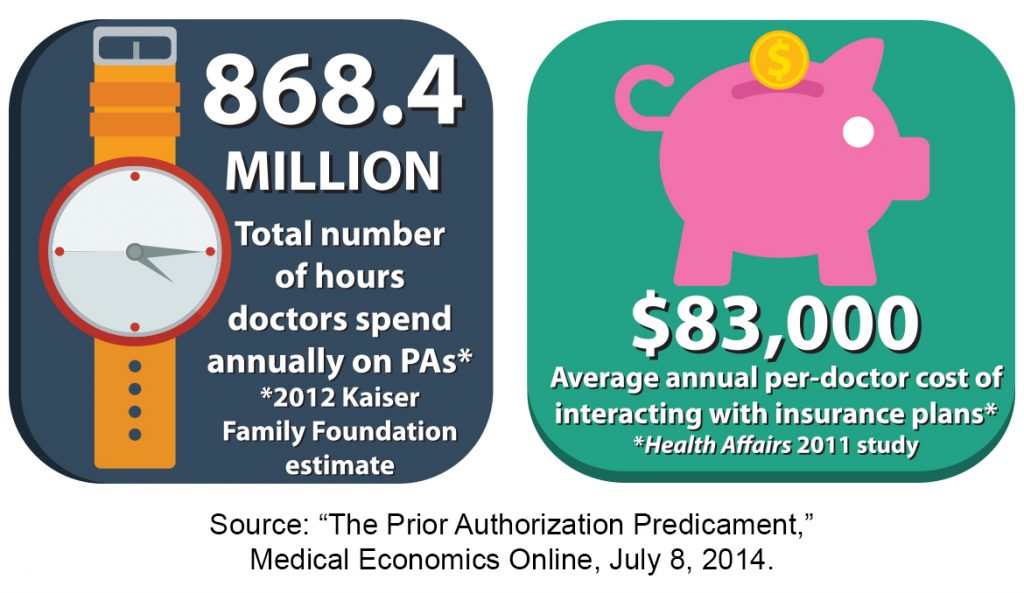

According to a 2012 Kaiser Family Foundation estimate of about 835,000 practicing physicians, 868.4 million hours are spent annually on PAs. A 2011 study by Health Affairs estimated physicians spend an average of $83,000 annually interacting with insurance plans to secure prescribed treatments, procedures or therapies for patients needing prior approvals.

In Dr. Carter’s practice, he and his partner treat a variety of issues in their patients ranging from colds and flu to more chronic conditions like diabetes and ADHD as well as procedures involving MRIs and X-rays. Each physician has a staff member devoted to prescription renewals and obtaining PAs. Still, keeping up with the demands of charting and following the rules for the payers for PAs can be daunting.

“When a patient comes in that you’ve been treating for months or even years, and you know there’s something new out there that will work better for that situation, you want to find what works best for your patient. Most of the time, that medication is going to be a generic, which is covered by most insurance plans because it’s cheaper for them and it’s cheaper for your patient. But, what if that med doesn’t work for your patient? What if your patient is allergic to that med or another med? You have to find a balance. That’s the key,” Dr. Carter said.

“When a patient comes in that you’ve been treating for months or even years, and you know there’s something new out there that will work better for that situation, you want to find what works best for your patient. Most of the time, that medication is going to be a generic, which is covered by most insurance plans because it’s cheaper for them and it’s cheaper for your patient. But, what if that med doesn’t work for your patient? What if your patient is allergic to that med or another med? You have to find a balance. That’s the key,” Dr. Carter said.

For specialists like oncologist Stephen Davidson, M.D., at the Montgomery Cancer Center, issues with PAs can begin when the patient checks in for the first appointment.

“There are days when I have patients who are scheduled to see me as new patients. They are at the front door. They have something that brought them here that has also emotionally disturbed them greatly. If their PA is not in place, they can’t so much as walk down the hall to see me,” Dr. Davidson said. “This happens…constantly.”

Dr. Davidson and his team see an average of 60 patients each day. During that time, he and his treatment team are also securing PAs for patients for imaging and medicine. Rarely are cancer medications generic, making them very expensive, so PAs must be secured for monthly refills, taking even more time away from patient care.

“It has become a tremendous burden,” Dr. Davidson said. “Somewhere along the way the burden of proof shifted from the insurance company to the physician. Traditionally there has been a respect for a physician’s judgment and decision making on behalf of the patient. That’s a very special and sacred relationship. Now, because of a number of factors, primarily economic, we have insurance companies that don’t respect the physician’s authority in the decision-making process.”

According to Dr. Davidson, the burden of proof isn’t specific to oncology. Physicians fighting to get the best treatment regimens for their patients have all experienced the same process with payers in trying to secure prior authorizations, and perhaps the most time consuming and frustrating part of the system is the peer-to-peer conversations in which physicians advocate on behalf of their patients with the payers.

“The problem is that in oncology specifically, and with medicine in general, it’s not black and white,” Dr. Davidson said. “There is a lot of leeway. There is a lot of individualism for treatment plans for patients, so problems start to happen when major insurance companies hire third-party companies to come in and do nothing but screen all your imaging and either green-light or red-light your treatment plans.”

For both of these physicians, the delay caused by the waiting game can put the patient’s health in the balance. Dr. Carter often encourages his patients to engage in the appeals process with their health insurance plan by calling the numbers listed on their insurance cards. Dr. Davidson has enlisted the assistance of his patients as well.

“When the patient calls the insurance company and gets into the conversation, it shows just how much the patient is concerned about the situation,” Dr. Carter said. “It absolutely helps for the patient to get involved and review with their insurance company what treatments have already been tried, and why they didn’t work. The patient is looking for a solution just as much as the physician.”

Fortunately, in Dr. Carter’s experience, a reply for a PA request usually takes 24 to 48 hours. Things get more complicated, however, for specialists like Dr. Davidson.

“There is more bureaucratic pressure placed on the medical practice and more delay and anxiety on the part of the patient (when dealing with PAs),” Dr. Davidson said. “We are a larger facility, and we have five full-time employees that deal with nothing but authorizations. It’s still a burden for us. I don’t know how smaller practices deal with it. Essentially your first swipe at the PA is a website, so someone is taking a patient’s medical record and actually typing it into an online form to see if it will fit exactly cookie-cutter into this form. The patient is not cookie cutter. There is no way to cookie cutter every patient, no matter what the specialty or situation.”

Some states have pursued legislative solutions to PA problems, but with little success, as insurance companies and their lobbyists come out in droves in opposition. As non-physicians increasingly attempt to dictate health care delivery, the Medical Association is committed to finding solutions to PAs and other related issues so that we keep health care decisions between doctors and patients.

Posted in: Advocacy

Leave a Comment (0) →