Tag: CMS

-

CMS Announces New Funding Opportunity for Quality Payment Program (MACRA)

The Centers for Medicare and Medicaid Services recently announced a new funding opportunity for development, improvement and expansion of quality measures for the Quality Payment Program. According to CMS, the program over three years will provide up to $30 million in funding and technical assistance to clinicians, patients and others working on QPP measures. These…

-

CMS Updates Open Payments Data

On January 17, CMS updated the Open Payments dataset to reflect changes to the data that took place since the last publication on June 30, 2017. CMS updates the Open Payments data at least once annually to include updates from disputes and other data corrections made since the initial publication of the data. The refreshed…

-

Now Available: CMS Data Submission System for Clinicians in the Quality Payment Program

CMS Launches New Data Submission System for Clinicians in the Quality Payment Program On Tuesday, Jan. 2, the Centers for Medicare & Medicaid Services launched a new data submission system for clinicians participating in the Quality Payment Program. Clinicians can now submit all of their 2017 Merit-based Incentive Payment System data through one platform on…

-

CMS Issues Final Rule on 2018 Medicare Reimbursement

The Centers for Medicare & Medicaid Services has issued a final rule that includes updates to payment policies, payment rates, and quality provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2018. Background on the Physician Fee Schedule Payment is made under the PFS for services furnished by…

-

CMS Announces New Medicaid Policy to Combat Opioid Crisis

Just a week after President Trump declared the opioid epidemic a public health emergency, the Centers for Medicare & Medicaid Services (CMS) announced a new policy to allow states to design demonstration projects that increase access to treatment for opioid use disorder (OUD) and other substance use disorders (SUD). CMS’s new demonstration policy responds to…

-

Participate in Field Testing of Episode-Based Cost Measures by Nov. 15

The Centers for Medicare & Medicaid Services is conducting a field test for eight episode-based cost measures before consideration of their potential use in the cost performance category of the Merit-based Incentive Payment System (MIPS) of the Quality Payment Program. During the field test, clinicians may access confidential feedback reports with information about their performance…

-

CMS Cancels Some Bundled Payment Proposals

CMS released a proposed rule that reduced the number of mandatory geographic areas for the joint bundled payment program and cancels the cardiac bundled payment program model. In response to the cut, the American College of Cardiology released a statement indicating the ACC “will continue to work with CMS on opportunities for clinicians to participate…

-

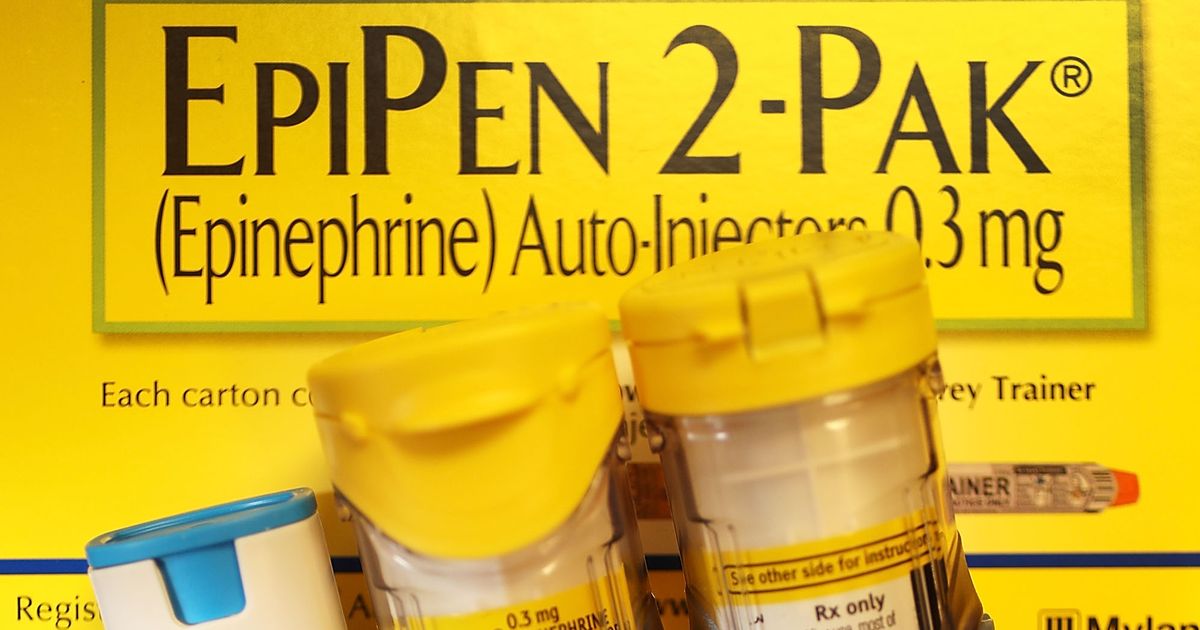

Mylan Finalizes Settlement Agreement on Medicaid Rebate Classification for EpiPen® Auto-Injector

The Centers for Medicare & Medicaid Services announced an agreement with Mylan regarding the classification of EpiPen in which Mylan will reclassify EpiPen as a brand name drug consistent with the Medicaid statute and regulations. In addition, Mylan has agreed to use the correct reference price of the 3rd quarter of 1990 for the purpose…

-

Medical Association Joins 132 Medical Groups to Oppose H.R. 2276

The inclusion of audiologists in Medicare’s definition of “physician” will create confusion. In May, legislation (H.R. 2276) was reintroduced in the U.S. House of Representatives that would inappropriately provide audiologists with unlimited direct access to Medicare patients without a physician referral and amend Title XVIII of the Social Security Act to include audiologists in the…

-

Free AQAF Assistance: Transition to MACRA’s Quality Payment Program

The Alabama Quality Assurance Foundation (AQAF), located in Birmingham, is a nonprofit consulting firm providing quality improvement assistance to the health care provider market through contract arrangements. Part of AQAF’s contract with CMS is to provide training to clinicians on the Medicare Access and CHIP Reauthorization Act (MACRA), the Merit-based Incentive Payment System (MIPS) or an…