Category: Coronavirus

-

Supreme Court Rules on Vaccine Mandates

By: Brandy A. Boone, General Counsel of the Medical Association of the State of Alabama The US Supreme Court (“the Court”) recently released differing opinions on the two-part Biden administration vaccine mandate. In Biden v. Missouri1, the Court lifted a US District Court’s stay on enforcement of the Department of Health and Human Services’ (HHS)…

-

CMS Issues COVID-19 Health Care Staff Vaccination Interim Final Rule

by Lindsey Phillips, Burr & Forman, LLP On November 4, 2021, the Centers for Medicare & Medicaid Services (“CMS”) announced its interim final rule regarding vaccination requirements for eligible staff of certain healthcare providers. The rule, which becomes effective on November 5, 2021, is expected to apply to approximately 76,000 healthcare providers and cover over…

-

NEW STATE OF EMERGENCY PROVIDES HEALTHCARE PROVIDER FLEXIBILITIES

By Angie Cameron Smith with Burr & Forman, LLP On July 6, 2021 Governor Kay Ivey allowed the State of Emergency in Alabama to expire. She had previously proclaimed a State of Emergency due to the COVID-19 Pandemic effective March 13, 2020. Along with that proclamation, came the invocation of Alabama’s Emergency Management Act. When…

-

Not a “Rock Throwing” Committee; Pandemic Response Task Force Holds First Meeting

On Thursday, July 1, the first meeting of a legislatively-created task force to examine the state’s response to the COVID-19 pandemic was held in Montgomery. During the 2021 Legislative Session, amidst a flurry of bills being introduced related to the pandemic (like Sen. McClendon’s bill to abolish the position of State Health Officer and abolish the State Committee of Public…

-

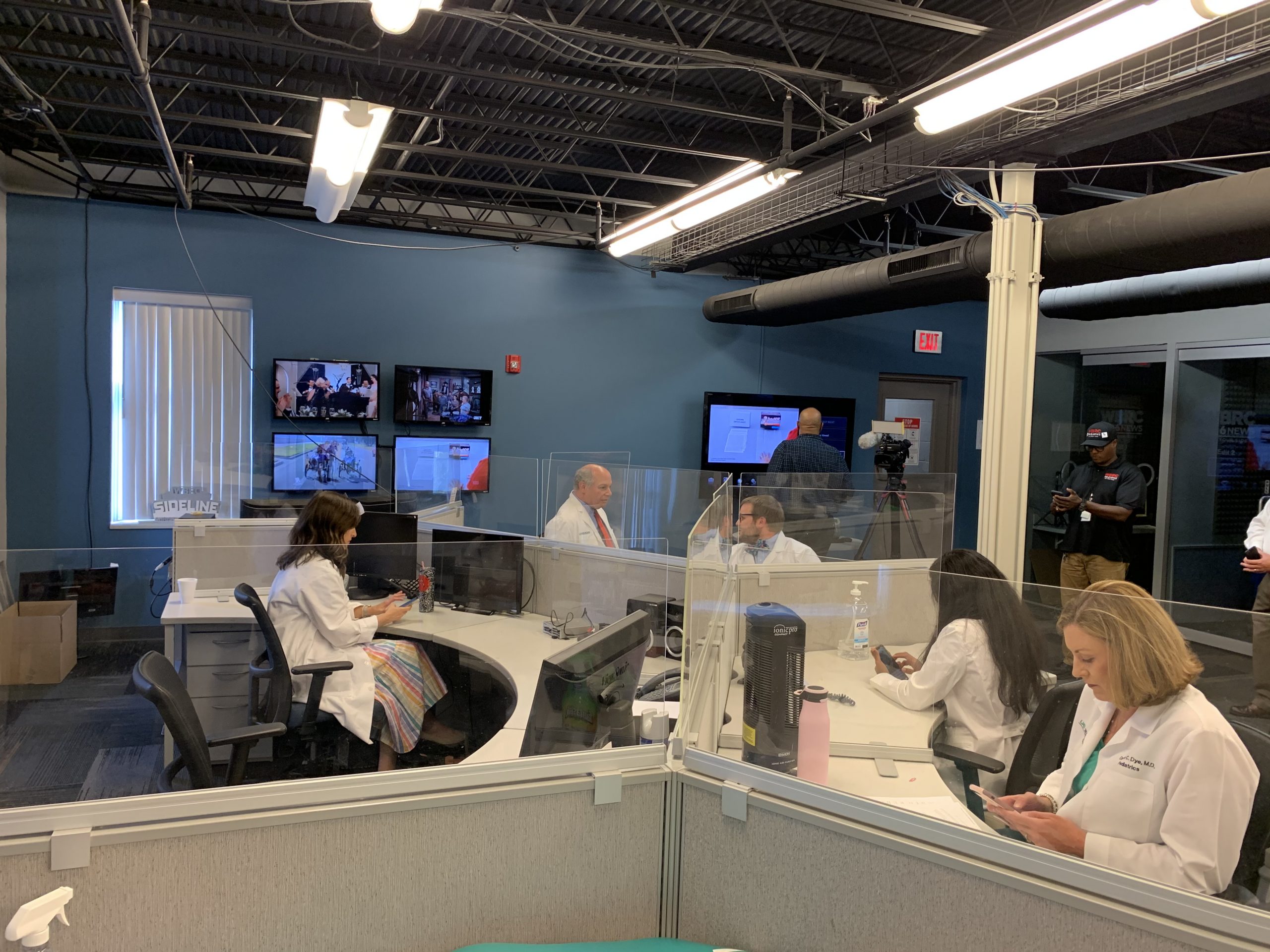

Alabama Doctors Host Two Telethons to Answer Viewers’ Questions About COVID-19 Vaccines

Last Thursday, doctors with the Medical Association of the State of Alabama and the Alabama Chapter of the American Academy of Pediatrics answered questions from over 200 callers about the safety and effectiveness of COVID-19 vaccines during newscasts on WBRC Fox 6. Yesterday another group of our physicians went live on air with WKRG in…

-

Are You Ready for Your PPP Loan Audit?

By: Jim Hoover, Burr & Forman PPP loans received by individuals and businesses under the CARES Act will be audited (“reviewed”) by the SBA. PPP loans of $2 million or more will automatically be audited by the SBA. Many PPP loans of less than $2 million will also be audited. Borrowers will often receive notification…

-

Op-ed: Alabama physicians face challenges head-on during vaccine rollout

By: John Meigs, Jr., MD, President – Medical Association of the State of Alabama Because of a seemingly slow rollout of the COVID-19 vaccine, physicians have started to hear many concerns from their patients. Understandably, the people of Alabama are growing more eager each day to get vaccinated. Physicians were privileged to be included in…

-

Op-ed: Physicians are no longer on the front lines of this pandemic. You are.

John Meigs, Jr. – President, Medical Association of the State of Alabama State Health Officer is a difficult role to fill, especially this year. While partisanship and conspiracies continue to divide us, it is the job of the State Health Officer to make decisions for the good of all people throughout Alabama. This is exactly…

-

Phase 3 Provider Relief Funds Announced by HHS

On October 1, 2020, the Department of Health and Human Services (“HHS”) announced an additional $20 billion in funding for healthcare providers to assist with losses and changes in operating expenses caused by the current COVID-19 pandemic. This additional funding is a result of the CARES Act and the Paycheck Protection Program and Health Care…

-

Physicians Perspective: Dr. Chris Adams Talks Telemedicine

Adversity and necessity mandate invention. During the COVID-19 pandemic, telemedicine has been transformed almost overnight into a necessary medical tool for remaining connected to our patients. Without warning, physicians suddenly found themselves in the position of adding communication technologies, learning regulatory requirements, and adapting to an entirely new way of interacting with patients, sometimes reinventing…