Tag: administrative

-

CMS Proposes 2018 Payment and Policy Updates for the Physician Fee Schedule

The Centers for Medicare & Medicaid Services issued a proposed rule that would update Medicare payment and policies for doctors and other clinicians who treat Medicare patients in the calendar year 2018. The proposed rule is one of several Medicare payment rules for CY 2018 that reflect a broader strategy to relieve regulatory burdens for…

-

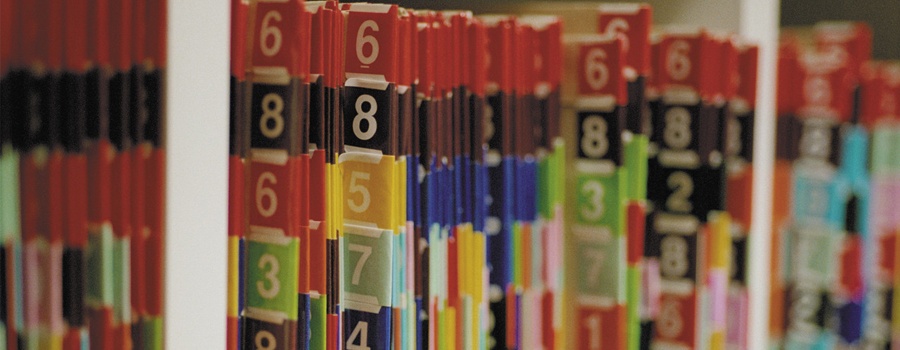

A Refresher in the Medicare Claims Appeals Process…

With the increased audit activity we are seeing among the alphabet soup of Medicare contractors – RACs, ZPICs, SMRCs, CERTs, etc. – now appears to be a good time for a refresher on the Medicare claims appeals process. Due to this increased audit activity, more and more claims are being denied, both under pre-payment review…